All you need to know about DAC7 reporting

What is DAC7?

DAC7, or the 7th version of the European Council Directive on Administrative Cooperation and Automatic Exchange of Information in the Field of Taxation, is part of an initiative to improve tax cooperation among European Union countries, primarily affecting online platforms and their sellers (gig economy, freelance economy, used goods sales).

The new rule requires online platforms (marketplaces) to collect and verify the identifying information of EU sellers who use their services, as well as disclose information to their local tax authorities once a year. The local tax authority will subsequently share the information with all tax authorities in EU member states, resulting in greater transparency about taxpayer activities across the board.

Abill.io offers automated & compliant payments to platform sellers and creators via API, combined with DAC7 data collection and reporting for online platforms, marketplaces, streaming platforms, gig work & creator platforms.

Our services include: XML report files from CSV DAC7 report generator for 2023 and DAC7 reporting as a service for future reports.

Click here to learn more about abill.io services

Who has to report?

The DAC7 rules are applicable to digital platform operators who support the sale of products or services, the renting of immovable property, or the rental of any mode of transportation.

This programme affects platforms of all sizes both within and outside of the EU.

- Rental of immovable property, including residential and commercial property, and parking spots (e.g., Airbnb, Booking.com).

- Rental of any kind of transportation (e.g., Turo, Click&Boat).

- Time or task-based personal services provided at the request of a user (e.g., Uber, Upwork, Fiverr).

- Sales of items (e.g., through e-commerce platforms like eBay and Amazon)

To be considered reportable, transactions must be monetary in nature and paid to the seller in a fashion that the digital platform can verify.

Sellers of goods (only) with fewer than 30 transactions and less than EUR 2,000 (total per year) are exempt from the platform's reporting requirements.

Digital platforms comprise software programmes (mobile or desktop), websites, or elements of a website that connect sellers and buyers and enable them to conduct sales transactions (DAC7 refers to these as "Relevant Activities").

Excluded - websites that just list services or items and do not participate in transactions or payment distribution (Facebook Marketplace, Craigslist, and Stripe, Wise, Paypal, and Ayden).

What and when should I report?

Platform operators must gather and report data on the following:

- the seller's personal details (name, date of birth, primary address)

- Their tax identification number (TIN or VAT number)

- Business registration number

Transaction amounts:

- Financial accounts utilised

- Fees and taxes deducted by the platform operator

- Rental property addresses and rental periods (for each property)

Platforms must submit information by January 31, following the calendar year in which the reportable seller sold goods or services through their platform, with the first reporting period beginning in 2023.

- Ireland extended till 7 February 2024.

- Italy extended till 15 February 2024.

- Spain’s deadline hasn’t been announced yet.

- Poland could potentially postpone their DAC7 reporting deadline to the end of the year.

Platforms have until December 31, 2024 to complete due diligence procedures for existing pre-2023 sellers, check their personal and tax identity information, and gather any missing information.

Data to be collected

The Platform Operator must report:

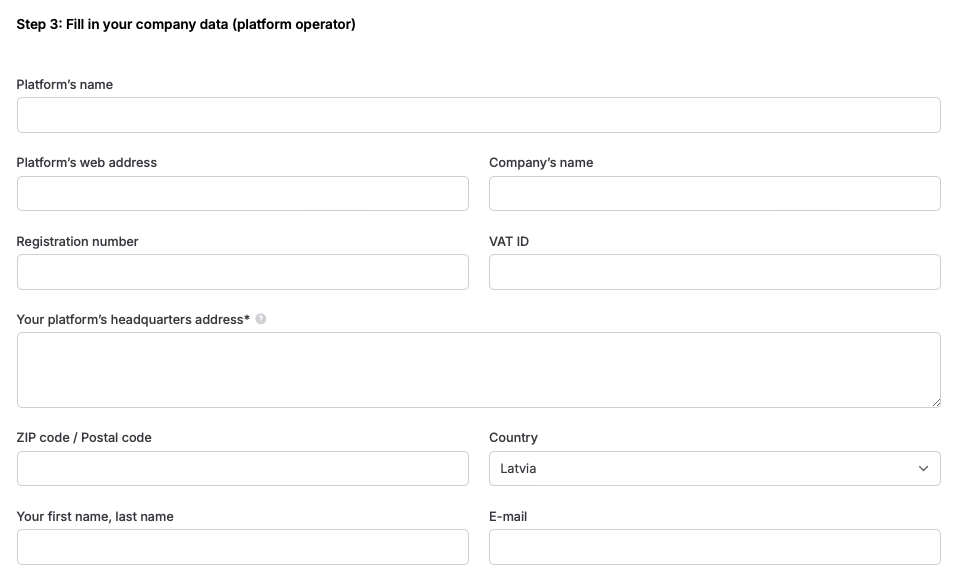

1. The company’s information

2. Seller's information:

Table 1: Reportable Seller as a Person

| Information Required |

|---|

| - First and last name |

| - Main address |

| - Date of birth |

| - Tax identification number (TIN) and VAT ID |

| - Details of the address of the property and the land register number if a property is rented in the EU |

| - The total consideration paid or credited per quarter |

| - The number of relevant activities paid for or credited |

| - Any fees, commissions or taxes withheld or levied by the Reporting Platform Operator |

Table 2: Reportable Seller as a Legal Entity

| Information Required |

|---|

| - Legal name |

| - Main address |

| - Tax identification number |

| VAT identification number |

| - Financial bank account identification number |

| - Registeration number (Chamber of Commerce number) |

| - Information regarding the presence of a permanent establishment through which relevant activities are carried out in the EU [if any] |

| - Details of the address of the property and the land register number if a property is rented in the EU |

| - The total consideration paid or credited per quarter |

| - The number of relevant activities paid for or credited |

| - Any fees, commissions or taxes withheld or levied by the Reporting Platform Operator |

The Platform is obligated to ‘verify’ whether the information gathered about the sellers is correct. The Platform can do so by using ‘any information and documents available’. We therefore expect a check of internal documents and publicly available information to suffice.

How and where to report?

Platform Operators under DAC7 can complete their reporting responsibilities for the entire EU by providing all of their EU data in a single member state.

Platform Operators with at least one registered firm (or permanent establishment) in one of the EU member states must provide their data to the appropriate country's tax authorities.

Platform operators with several entities in EU member states can submit from any of these nations.

Platform operators who do not have a registered presence (or permanent installations) in an EU member state may submit their data from any EU country.

Data submissions to tax authorities will require a direct internet connection, such as through a tax authority API, SOAP, or other comparable electronic approach.

Platform Operators can establish a direct tax authority connection internally or hire external companies to handle electronic data submission on their behalf.

Abill.io offers automated & compliant payments to platform sellers and creators via API, combined with DAC7 data collection and reporting for online platforms, marketplaces, streaming platforms, gig work & creator platforms.

Our services include: XML report files from CSV DAC7 -report generator for 2023 and DAC7 reporting as a service for future reports.

Click here to learn more about abill.io services

The Complete List of Tax Authority Websites in the EU, DAC7 Technical information and Penalties

Austria

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): EUR 200,000

Belgium

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): EUR 50,000

Bulgaria

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): -

Croatia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): EUR 26,540 per breach

Cyprus

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): -

- Guidance: OECD FAQs

- Penalties (up to): EUR 20,000

Czechia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): EUR 60,000 per breach

Denmark

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Q&A

- Penalties (up to): DKK 80,000

Estonia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Q&A

- Penalties (up to): EUR 3,300

Finland

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): EUR 15,000

France

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

- Penalties (up to): EUR 50,000

Germany

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): EUR 50,000

Greece

- Legislation: Link

- Tax Authority Website on DAC7: -

- DAC7 Technical Documentation (XML schema): -

- Guidance: -

- Penalties (up to): -

Hungary

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): HUF 2,000,000

Ireland

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

- Penalties (up to): EUR 19,045

Italy

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

- Penalties (up to): EUR 31,500

Latvia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): 14,000

Lithuania

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): -

Luxembourg

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): EUR 250,000

Malta

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

- Penalties (up to): EUR 19,250

Netherlands

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: FAQ

- Penalties (up to): EUR 900,000

Poland

- Legislation: Link

- Tax Authority Website on DAC7: -

- DAC7 Technical Documentation (XML schema): -

- Guidance: -

- Penalties (up to): -

Portugal

- Legislation: Link

- Tax Authority Website on DAC7: -

- DAC7 Technical Documentation (XML schema): -

- Guidance: -

- Penalties (up to): -

Romania

- Legislation: Link

- Tax Authority Website on DAC7: -

- DAC7 Technical Documentation (XML schema): -

- Guidance: -

- Penalties (up to): RON 100,000

Slovakia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): EUR 10,000 per breach

Slovenia

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

- Penalties (up to): EUR 30,000

Spain

- Legislation: Link

- Tax Authority Website on DAC7: -

- DAC7 Technical Documentation (XML schema): Link

- Guidance: -

- Penalties (up to): EUR 200 per Seller

Sweden

- Legislation: Link

- Tax Authority Website on DAC7: Link

- DAC7 Technical Documentation (XML schema): Link

- Guidance: Link

Penalties (up to): SEK 2,500 per Seller

Noncompliance Penalties

In the event of noncompliance, tax authorities may levy hefty penalties on Platform Operators. Penalties vary by nation, ranging from a few thousand euros per false seller record to EUR 900,000 in the Netherlands (see table above) for a Platform Operator who knowingly avoids its reporting duties. In addition to financial penalties, the EU may opt to altogether prohibit access to non-compliant platforms in egregious circumstances.

GDPR & DAC7

One recurring concern is the combination of DAC7 and Europe's recently implemented data privacy legislation. While DAC7 requires platform operators to collect, validate, and report data, the General Data Protection Regulation (GDPR) requires them to do so without infringing on reportable vendors' data protection rights. It is apparent that GDPR does not prohibit or excuse platform operators from gathering the necessary data from reportable merchants.

To be GDPR compliant, platform operators must, among other things, notify individual reportable sellers that their data will be collected and disclosed to the appropriate authorities.

Abill.io offers automated & compliant payments to platform sellers and creators via API, combined with DAC7 data collection and reporting for online platforms, marketplaces, streaming platforms, gig work & creator platforms.

Our services include: XML report files from CSV - DAC7 report generator for 2023 and DAC7 reporting as a service for future reports.

Click here to learn more about abill.io services

Abill.io can help you generate DAC7 report XML files only for sellers of services (not goods, not rentals) who are individuals (not companies).