What are we gonna talk about:

What Is Employee Classification and Why Does it Matter?

Employee vs. Independent Contractor: Key Differences in Employee Classification

The Consequences of Getting Classification Wrong

What Happens When You Misclassify an Employee

1. Hefty Fines and Financial Penalties

2. Personal Liability for Company Leaders

3. Back Taxes and Unpaid Contributions

4. Lawsuits from Misclassified Workers

5. Reputational and Operational Damage

How Abillio Supports Accurate Employee Classification

1. Smart Classification Checks During Onboarding

2. Built-in Platform Safeguards

3. Every Invoice Includes a Built-in Service Agreement

4. KYC and Fraud Prevention

5. Automated Tax Reporting

Conclusion

FAQs

Roughly 1 in 3 businesses misclassify at least one worker, often without realizing it.

With independent contractors now making up nearly half the global workforce, that risk is only growing. What might seem like a simple contract or short-term engagement could quickly turn into a costly compliance issue if you’re not clear on how to classify your workers properly.

Employee classification is more than just a checkbox on a form. It determines whether someone is legally considered an employee or an independent contractor, and getting it wrong can lead to back taxes, penalties, audits, and even reputational damage.

In this guide, we’ll walk you through the key differences between employees and independent contractors, what misclassification actually means, the risks involved, and how to make sure your business stays compliant from day one.

What Is Employee Classification and Why Does it Matter?

Employee classification is the process of legally defining the relationship between your business and the people you hire specifically, whether they’re considered employees or independent contractors under the law.

It might seem like a small detail, but it impacts everything: how someone gets paid, who handles taxes, whether benefits apply, and which labor laws protect them.

The tricky part? You can’t just choose the most convenient label. Classification is based on legal criteria: things like the level of control, independence, and how integrated the person is within your business. And those criteria can vary depending on the country, or even the region, you’re hiring in.

Misclassifying someone, intentionally or not, can lead to serious consequences: back taxes, fines, legal disputes, and damage to your company’s reputation.

Why does it matter?

- Legal compliance: Proper classification ensures you’re following local labor laws and giving workers the rights and protections they’re entitled to.

- Tax accuracy: Employees and contractors are taxed differently. Getting it wrong can lead to unpaid taxes, penalties, and government audits.

- Fair treatment: Workers classified correctly receive the appropriate benefits, protections, and responsibilities for their role.

- Business flexibility: Knowing how to correctly structure roles helps you build a compliant, adaptable workforce.

- Reputation management: Consistently misclassifying workers can harm your credibility with clients, partners, and future hires.

Employee vs. Independent Contractor: Key Differences in Employee Classification

Understanding the distinction between an employee and an independent contractor is essential for any business working with a flexible or distributed workforce. While both may contribute valuable skills and results, how they are classified affects tax obligations, legal responsibilities, and overall risk.

The visual below outlines the key differences between these two classifications.

The Consequences of Getting Classification Wrong

Employee misclassification happens when a worker is labeled as an independent contractor, but their working conditions and relationship with the company actually meet the legal criteria for employment. This issue is widespread, especially in industries that rely heavily on flexible or project-based work, such as tech, logistics, construction, creative services, and platform-based gig roles.

In many cases, misclassification is unintentional. A company might assume that a short-term or remote worker should automatically be treated as an independent contractor. But legal classification doesn’t depend on job titles or contract length, it depends on the actual nature of the working relationship.

Why Misclassification Matters

For example, if a contractor works regular hours, uses company tools, reports to a manager, and performs tasks essential to the business, local authorities may determine they’re effectively functioning as an employee. And in that case, the company may be responsible for unpaid taxes, missed benefit contributions, and potential penalties.

In other cases, misclassification can be deliberate, used as a way to cut costs or avoid obligations tied to employment laws. This kind of practice is increasingly being scrutinized by governments and regulators, particularly as more countries rely on tax revenues to fund public benefits and worker protections.

A well-known example came in 2022 when Uber was ordered to pay $100 million after an audit in New Jersey found it had misclassified its drivers as independent contractors. The case highlighted how governments are cracking down on misclassification across high-growth industries and sent a clear message to companies relying heavily on contract-based models.

The laws surrounding worker classification vary by country, but the core factors are often similar. Authorities typically assess who controls how and when the work is done, whether the worker is economically dependent on the company, and whether the work is a core part of the business.

Misclassification doesn’t just impact government revenues. It affects the worker too. When someone is wrongly classified as an independent contractor, they may lose access to benefits like paid leave, health insurance, unemployment protections, and retirement contributions. They’re also responsible for covering their own taxes and social contributions, without the legal safety nets employees usually receive.

For businesses, this can become a serious compliance risk. A misclassification dispute can lead to audits, back payments, reputational damage, or even court cases especially when hiring internationally.

That’s why it’s important to understand what’s really at stake when classification goes wrong, and how those risks can impact your business on multiple levels.

What Happens When You Misclassify an Employee

Misclassifying someone as an independent contractor when they should legally be an employee doesn’t just cause confusion, it can lead to serious consequences for your business, both financially and legally.

And it’s not just businesses that face the consequences. Misclassification affects both sides.

Workers can lose access to essential benefits and protections like health insurance, retirement plans, overtime pay, and other legal rights. On top of that, they also become responsible for paying both the employer’s and employee’s share of Social Security and Medicare taxes, which can result in significant financial burdens.

Employers, meanwhile, can face consequences such as:

1. Hefty Fines and Financial Penalties

The size of the penalty depends on where your business operates, but one thing is clear: enforcement is increasing. Some countries issue flat-rate fines, while others calculate penalties based on how many workers were misclassified, or how much tax and social contribution revenue was lost.

High-profile companies have faced multi-million-euro fines for misclassification, making it clear that regulators are taking this issue seriously.

A high-profile example is Glovo, a Spanish delivery platform. In 2022, it was fined nearly €79 million for misclassifying thousands of its couriers as independent contractors. The following year, it faced another fine of around €57 million for similar violations. Although Glovo has appealed both decisions, the message is clear, misclassification is firmly on the radar of labor authorities.

2. Personal Liability for Company Leaders

In several countries, including Australia, France, and Germany, misclassification doesn’t just affect the company. Directors, board members, and senior officers can be held personally liable if the misclassification was intentional or negligent. In extreme cases, this can lead to criminal charges, personal fines, or even prison time.

3. Back Taxes and Unpaid Contributions

Misclassified workers often mean unpaid payroll taxes, social security contributions, and other mandatory payments. Once discovered, governments will require employers to pay everything owed, often with interest and additional penalties. A single misclassified worker over several years can quickly lead to a sizable bill.

4. Lawsuits from Misclassified Workers

Workers who were wrongly classified can file legal claims for compensation. These typically cover things like unpaid wages, holiday pay, missed benefits, and even lost employment protections. In one UK case, a misclassified worker successfully claimed six years’ worth of unpaid holiday pay. These types of cases are becoming more common and more expensive.

5. Reputational and Operational Damage

Beyond the financial hit, misclassification can harm your reputation. Public lawsuits, disputes with workers, and ongoing audits don’t just drain resources, they can erode trust with clients, investors, and future hires.

In short, misclassification is a growing global compliance risk and not one to be taken lightly. The penalties are real, and the costs, both visible and hidden, can add up fast.

How Abillio Supports Accurate Employee Classification

1. Smart Classification Checks During Onboarding

Every contractor goes through a short compliance questionnaire designed to flag misclassification risks early. These questions help assess whether the working relationship truly qualifies as independent. Here’s a look at what we ask:

- Is the income you earn from this client currently your only source of income?

- Do you have a designated workplace or rest area at the client’s company?

- Does your agreement specify that the service must be delivered on fixed days or hours?

- Are your holidays or time off dependent on the client’s internal work schedule?

- Do you have autonomy in decision-making when completing your work?

- Do you perform the work using your own tools and equipment?

2. Built-in Platform Safeguards

To protect both clients and contractors, Abillio’s platform rules clearly prohibit:

- Issuing invoices for work performed by someone else

- Accepting payments on behalf of others

- Including third-party services in your own invoices

3. Every Invoice Includes a Built-in Service Agreement

Each service provided through Abillio is backed by a standardized agreement that confirms the contractor is working independently, not as an employee. When the client approves the invoice, they also confirm the service has been delivered, no employment relationship exists, and no claims will be raised. This protects both sides and creates a clear legal record of the transaction.

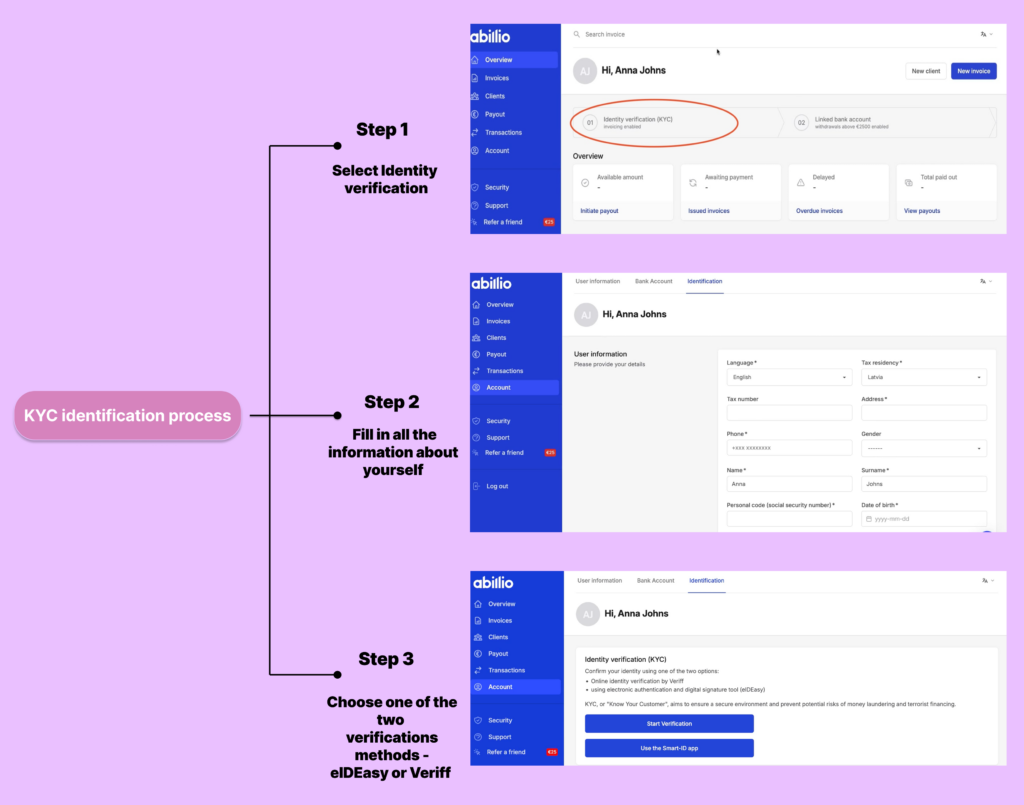

4. KYC and Fraud Prevention

We verify the contractor’s identity, and ownership of the bank account, and screen for politically exposed persons or individuals on sanctions lists, reducing the risk of impersonation or unauthorized payments.

5. Automated Tax Reporting

Abillio supports international compliance with built-in reporting for requirements like Form 1099 (U.S.) and DAC7 (EU). We handle reporting quarterly so you’re always prepared.

Conclusion

Getting employee classification right can feel like navigating a legal minefield, but it doesn’t have to be. With the right knowledge, clear processes, and the right tools in place, staying compliant becomes a lot more manageable.

The key is being proactive. Ask the right questions. Document everything. And don’t rely on guesswork when local laws demand precision.

Whether you’re hiring your first independent contractor or scaling a remote team across multiple countries, taking classification seriously now can save you from costly issues later.

And if you want to make it simple from the start? Abillio is here to help.

See how Abillio Pro can support your global hiring and compliance. Book a free demo.

FAQs

1. Can I Reclassify a Contractor as an Employee Later on?

Yes, you can, but it needs to be handled carefully. If the nature of the working relationship changes (for example, if a contractor starts working fixed hours under direct supervision), it may be time to shift them to employee status. Getting it right helps you avoid retroactive penalties.

2. Is There a Difference Between Freelancers and Independent Contractors?

The terms are often used interchangeably, but there are subtle differences. Freelancers usually work on smaller, short-term projects for multiple clients. Independent contractors may take on longer contracts and can sometimes operate as a business, even delegating work to others.

3. How Common is it for a Business to Misclassify Workers?

It’s more common than you might think. Some businesses misclassify workers by mistake, while others do it to cut costs. With the rise of the gig economy, the line between employee and contractor has become even harder to define, making misclassification a growing compliance risk.