Working in Germany as a freelancer

There is no need to register as a business entity or obtain a special trade permit if you intend to work as a freelancer in Germany.

Freelancer professions often fall under these categories:

- Web developers

- Graphic designers

- Content creators

- Freelance writers

- Marketing consultant

Your freelance activity must be registered with the German Tax Office rather than the trade office (Gewerbeamt). The tax office will issue you a tax number, which you will use to collect taxes on your freelance activities.

Being a freelancer has a few advantages:

- There is no need to register with the German Trade Register (Handelsregister)

- There is no need for a business license (Gewerbeschein)

- There is no need to pay trade tax (Gewerbesteuer)

- There is no need for double-entry accounting.

Register your business

If you want to register a business entity – here are the different requirements of business structures for independent contractors in Germany:

- Freiberufler- liberal professional

- Gewerbetreibender- self-employed/ sole trader

- Einzelunternehmen- sole proprietorship

- Kleingewerbe- a small business

Liberal professional (Freiberufler)

Some professions in Germany are classified as “liberal professions” (Freie Berufe in German). These are some of the liberal professions, according to local regulations EStG 18.

- Lawyers, tax consultants, and accountants

- Architects and engineers

- Doctors, dentists, veterinarians, and psychologists

- Journalists, translators, authors, and educators

- Photographers, musicians, designers, and actors are all examples of artists.

Practicing these professions requires more than just a laptop. You generally need an office, at which your clients visit you to pay for your services.

To find out if your profession is a liberal profession, contact the Institute of Liberal Professions or the German Tax Office.

Apply to the responsible Tax Office (Behördenwegweiser) in Germany to register as a liberal professional.

Registration in Germany as a Gewerbetreibender (self-employed individual)

You must register your business with the city’s Trade Office and acquire a business license (Gewerbeschein) This procedure is known as Gewerbeanmeldung (business registration).

You can register your self-employed activity with the Trade Office or apply for a freelancer tax number with the Tax Office.

Consult the Chamber of Industry and Commerce (IHK) or the Chamber of Skilled Crafts to verify you have all the necessary paperwork (ZDH).

If your operations fall under skilled crafts or a comparable sector, apply to the Chamber of Skilled Crafts for the Trades Register or the register of activities similar to skilled crafts.

Register your company with the Trade Office of the city in which you intend to open a business once you have gathered all the necessary paperwork. The Trade Office will notify all other pertinent agencies ( tax office, accident insurance fund, local court).

Registering a solitary proprietorship (Einzelunternehmen) in Germany

There is no minimum capital required for sole proprietorship registration in Germany, making it an attractive option for entrepreneurs and freelancers.

German law, however, distinguishes between two forms of sole proprietorships:

- Kleingewerbe- a small business

- Eingetragener Kaufmann- a commercial enterprise

Creating a Kleingewerbe (small business) in Germany

Kleingewerbe is a small business whose owners are exempt from complying with the norms of the German Commercial Code (HGB) and other commercial legislation. A small firm in Germany should generate less than €17,500 in its first year of operation and less than €50,000 in subsequent years.

The German Trade Register (Handelsregister) registration is optional for small firms. Choosing to register offers certain advantages, but considering the fees and duties, it is probably not the best option. With the application known as Fragebogen zur steuerlichen Erfassung, you can submit an application to the Handelsregister. You will receive a tax registration form from the tax office and a letter from the IHK (Chamber of Industry and Commerce) or HWK following business registration (Chamber of Skilled Crafts). Membership in the relevant HWK or IHK is required.

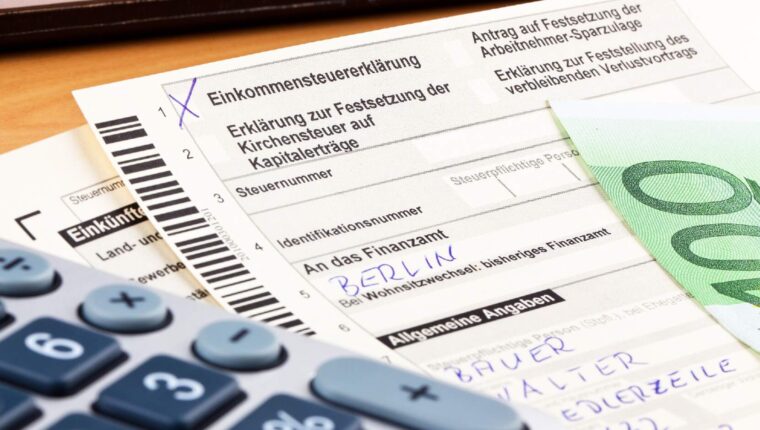

Taxation

Taxation in Germany depends on income. You will pay about 14% to 45% of your earnings on income tax, with the rate depending on your earnings:

- Up to €9,744 per year: exempt

- €9,745 – €57,918 per year: 14% to 42%

- €57,919 – €274,612 per year: 42%

- Over €274,613 per year: 45%

You will pay your income tax quarterly, and what you pay is based on estimations of your earnings. These are your advance payments or pre-tax.

Then, at the end of the year, you will calculate your actual earnings and submit an income tax declaration. It’s at this point you can receive reimbursements, if your advance payments exceed the actual amount.

Tax exemption

If your annual profit is less than €24,500, you are exempt from paying trade tax.

VAT

You will also be required to obtain a VAT identification number and pay VAT in addition to income tax. In Germany, VAT is known as Umsatzsteuer, and all sellers of products and services are required to charge VAT to customers within and outside of Germany. The payment must subsequently be sent to Finanzamt.

Depending on the instructions provided by your local tax office, you are required to submit your VAT charges monthly or quarterly. You can also report VAT receipts through the ELSTER portal.

Note that you are exempt from VAT if you make less than €22,000 in your first year as a freelancer and less than €50,000 in your second year. In these income ranges, you are termed a “Kleinunternehmer” (little business).

Alternatively, you can use Abillio – invoicing and tax compliance service for cross-border freelancing. In Abillio’s case, you don’t need to establish a legal entity, open bank account or apply for VAT – with Abillio’s company-as-a-service solution you can start your freelancing business right away.

Note: This information is from official sources and should not be considered as a substitute for legal advice. Always check official websites or consult a lawyer or tax consultant before taking action.