Updated on Jan 14, 2026

What are we gonna cover:

What Is Tax Residency

The 183-Day Rule

Common Tax Residency Triggers for Digital Nomads

How Digital Nomad Visas Are Changing the Tax Landscape

Tools to Stay on Track

FAQs

You’re working from a new country every few months. Your clients are global. Your taxes? Still a mystery.

Welcome to one of the least fun (but most important) parts of the digital nomad lifestyle: figuring out where you legally live, at least according to the tax office.

If you’ve ever asked, “Do I owe taxes here?” or googled “what is the 183-day rule?”, this guide is for you.

We’ll break down how taxes for digital nomads really work in 2026. You’ll learn what tax residency actually means, how it works across different countries, and what to watch out for if you want to stay out of trouble (and ideally, avoid paying taxes in multiple places).

What Is Tax Residency

It’s not about where you were born. Or what passport you hold. It’s about where governments think you live for tax purposes.

Usually, that’s where:

- You spend most of your time

- Your home or family is

- Your business is based

- Your money lives (aka your main bank accounts or investments)

Some countries go by the 183-day rule. Others care more about your “center of vital interests.” while a few claim you as a taxpayer based on citizenship alone (looking at you, United States 👋)

The country where you’re considered a tax resident has the right to tax your income, sometimes your worldwide income. If you’re moving between countries, not knowing your tax residency can leave you open to double taxation or surprise tax bills.

So, how do countries decide where you’re a tax resident?

The rules differ between countries, but most governments rely on a mix of common criteria to figure out where you officially “live” for tax purposes. Here’s what they typically look at:

- How long you stay: The famous 183-day rule is used by many countries (including the U.S., UK, and most of the EU). Spend more than half the year somewhere, and you’re likely considered a tax resident there.

- Where your home is: If you have a permanent home, whether owned or rented, that can be a strong signal. This also includes where your family lives and where you tend to settle outside of work.

- Your “center of vital interests”: If you’ve got ties to more than one country, authorities will look at where your key relationships and activities are based, your main income, business, and personal connections.

- Your intention: Some countries care about why you’re staying. If your plan is to live, work, or retire somewhere long term, that can be enough to establish tax residency. Countries like Canada, Australia, New Zealand, and Italy use this approach.

- Where you run your business: For companies, tax residency is often tied to where the business is incorporated or effectively managed.

- Your citizenship: When everything else is a tie, same number of days in two countries, homes in both, it can come down to nationality.

- Mutual agreement between countries: Still stuck? Some countries have tax treaties (also called double tax agreement) in place. These agreements help authorities decide who gets taxing rights, avoiding double taxation.

That’s why digital nomads need to be extra cautious. Even if you’re moving around, countries can still claim taxing rights based on any of these factors. Always check local rules, and when in doubt, speak to a tax advisor who understands cross-border situations.

The 183-Day Rule

This is the most famous (and most misunderstood) rule when it comes to taxes for digital nomads.

At its core, the 183-day rule means this: if you spend 183 days or more in a country during a single tax year, you’re likely considered a tax resident there, and that country may claim the right to tax your global income.

But the reality is more complex. Not every country applies this rule the same way. Some count any part of a day as a full day. Others have exceptions for travel days. And in many cases, it’s not just about the number of days you spend, but what kind of ties you create while you’re there.

In other words, staying under 183 days isn’t always enough to avoid becoming a tax resident. That’s why understanding local interpretations matters.

Here are a few examples of how different countries interpret the rule:

Germany: Even if you spend less than 183 days, Germany may still consider you a tax resident if you maintain a habitual abode or have a permanent home available. In practice, that could be an apartment you rent long-term, even if you’re not there all the time.

United Kingdom: UK uses a Statutory Residence Test (SRT). This includes not just how many days you spend in the UK, but also how many “ties” you have, like a UK home, job, or family. You can become a resident even with fewer than 183 days, depending on your connection score.

Portugal: Portugal applies the 183-day rule, but it also offers a special tax regime called the Non-Habitual Residency (NHR) program. If you qualify, you may be able to pay little or no tax on foreign-sourced income for 10 years, even if you spend more than 183 days in the country. This makes Portugal a popular choice for digital nomads looking to establish a base in the EU.

United States: The US applies the Substantial Presence Test, which looks at your presence over three years using a weighted formula:

Current year days + (1/3 × previous year days) + (1/6 × year before that)

If that total equals 183 or more, you’re considered a tax resident. And yes, this is in addition to the US taxing its citizens on worldwide income no matter where they live.

So, while 183 is a useful number to keep in mind, it’s just the beginning of the story. To stay safe, you’ll need to look at each country’s tax code and think about where you’re building meaningful ties.

Common Tax Residency Triggers for Digital Nomads

It’s not just about counting days. Many digital nomads accidentally trigger tax residency without realizing it. Here’s what else can make you a resident in the eyes of the tax office:

- Owning or renting a long-term home

- Registering a business locally

- Holding local bank accounts or credit cards

- Having family or dependents in the country

- Staying repeatedly over several years

Pro tip: Tourist visas don’t protect you from tax laws. Just because you’re not a formal resident doesn’t mean you’re off the hook for taxes.

How Digital Nomad Visas Are Changing the Tax Landscape

The rise of digital nomad visas has created new opportunities, and new complexities, for remote workers. These visas often make it easier to stay in a country legally for 6 to 12 months (sometimes longer), but they don’t always clarify what happens with your taxes.

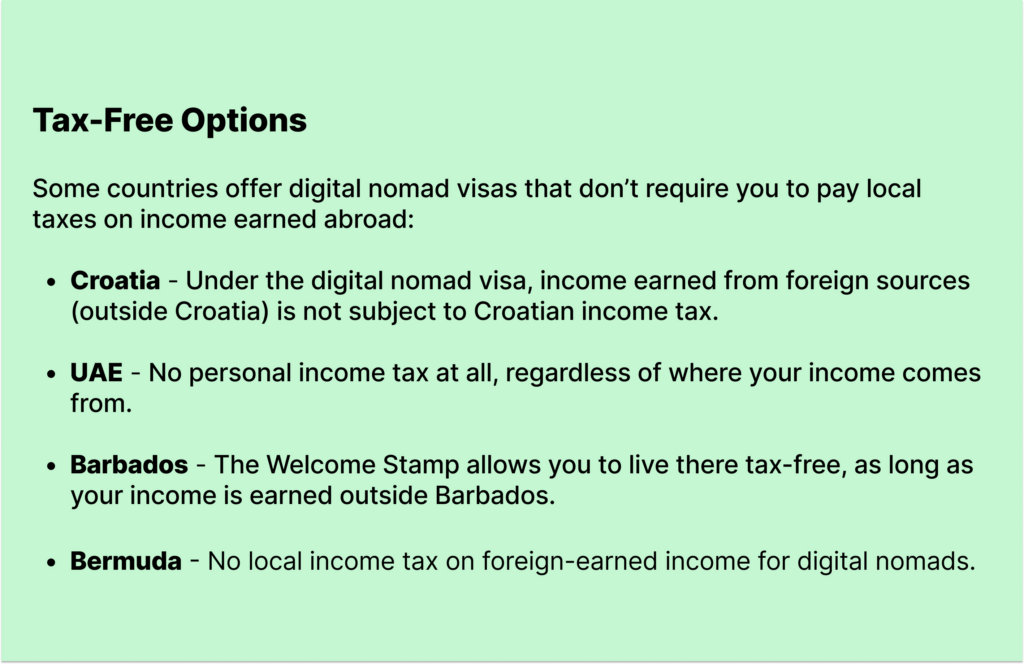

In some countries, digital nomad visas come with a clear statement: you’re not considered a tax resident, and your foreign income won’t be taxed.

In others, the visa may make it easier to live there, but if you stay long enough, or build certain ties (like renting a long-term apartment), you may still trigger tax residency.

That’s why it’s important to ask:

- Does this visa include a tax exemption or tax incentive?

- Will I need to file taxes locally even if I don’t owe anything?

- What happens if I extend my stay or come back year after year?

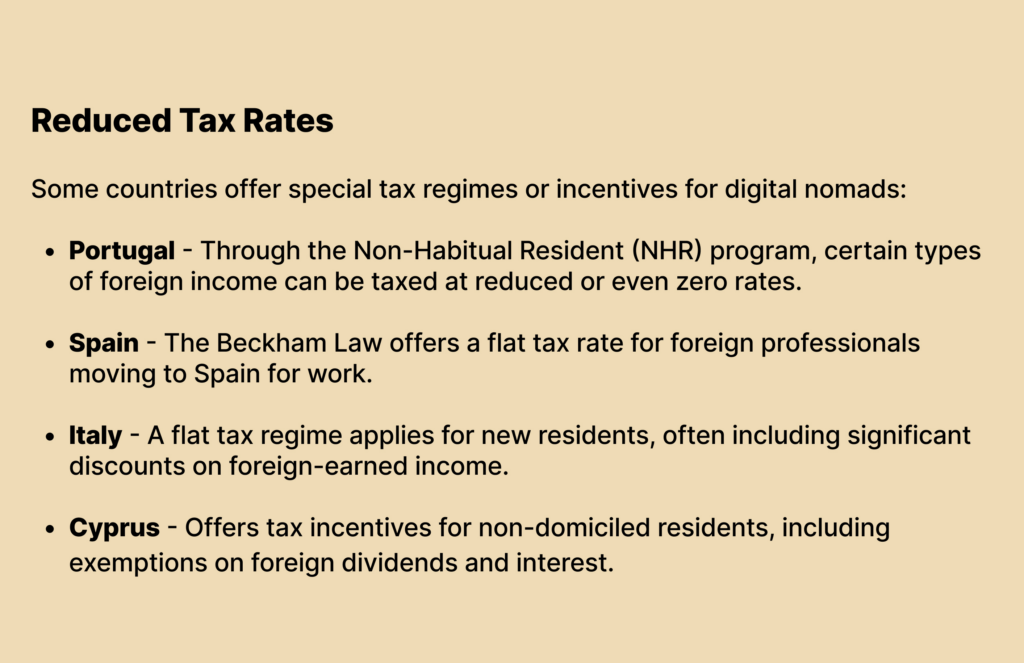

Now let’s take a look at how different countries handle taxation for digital nomads:

Bottom line: Just because you have a digital nomad visa doesn’t mean you’re in the clear on taxes. Always double-check the fine print and, when in doubt, ask a tax professional who understands cross-border rules.

Tools to Stay on Track

Abillio

If you’re working with clients around the world, Abillio makes it easy to stay on top of invoicing, compliance, and payments, without setting up a company. You can keep things tidy for tax time, no matter where you’re based. Perfect for nomads who don’t want to set up a full company just to get paid.

Abillio is now integrated with Xpate, allowing you to transfer money within one business day. It’s fast, flexible, and ideal for digital nomads who don’t want to wait weeks to access their earnings.

Tracking days

Automatically logs how many days you’ve spent in each country, so you don’t have to. Super helpful when you’re trying to avoid crossing the 183-day mark (or prove you didn’t). You can export reports, set alerts, and stop guessing where you “officially” live.

Notion

Great for organizing your life on the road: bucket lists, travel itineraries, remote job leads, or that ever-growing list of “books to read someday.”

Harvest

Perfect for freelancers who bill by the hour. Tracks your time by project, helps you stay focused, and makes invoicing way easier.

Google Drive or Dropbox

A simple way to keep your documents in one place. Easy to access, wherever you are.

FAQs

1. Can I have two tax residencies?

Yes, that’s called double tax residency. It can occur if two countries both see you as a resident based on things like time spent, homes, or personal and economic ties.

In that case, tax treaties usually apply “tie-breaker” rules to decide which country gets taxing rights.

2. Does Latvia have a digital nomad visa?

The Latvian government introduced the digital nomad visas in early 2022. This new visa allows remote workers and freelancers to live in Latvia for up to two years while working for companies abroad.

3. How do I prove where I’m a tax resident?

Tax authorities might ask for documentation – day counts, rental contracts, utility bills, or certificates of tax residence. Keep good records.