What are we gonna talk about:

What is Really Going On: The Psychology of Unpaid Invoices

How to Get Customers to Pay Past Due Invoices (Without Burning the Bridges)

Preventing Unpaid Invoices in the First Place

Conclusion

FAQs

You delivered the work. The client was happy. The invoice went out.

And then… crickets.

No reply. No payment. Just a growing sense of awkwardness and a sinking feeling that this might be one of those clients.

If you’ve ever had to chase a client for payment, you’re not alone. In fact, more than half of freelancers in the US have reported not being paid at least once. And while late payments hurt your cash flow, delay your own bills, and waste your time, there’s often more going on than just forgetfulness or bad budgeting.

Here’s the thing most people miss: unpaid invoices are as much about psychology as they are about finances.

Understanding why clients don’t pay, what’s happening emotionally or behaviorally behind the scenes, can change the way you approach overdue invoices. It gives you tools to nudge clients without nagging, get paid without burning bridges, and put systems in place so it doesn’t keep happening.

Let’s break it down.

What is Really Going On: The Psychology of Unpaid Invoices

Most clients don’t wake up thinking, “How can I avoid paying today?” But human behavior is rarely rational, especially when money is involved. Let’s unpack some of the deeper reasons behind late or missing payments.

1. Avoidance and Guilt

Clients facing cash flow problems may experience guilt, shame, or anxiety. Instead of dealing with the issue, they avoid it altogether. This creates a loop: the more they avoid you, the worse they feel and the less likely they are to respond.

What to do: Break the emotional cycle with empathy. A message like, “Just checking in, if there are any issues with the invoice or timing, I’m happy to work out a solution,” can lower their guard and open the door to communication.

2. The “Out of Sight, Out of Mind” is very real

Digital invoices get buried in inboxes, pushed aside by newsletters, calendar invites, and cat memes. Without a physical reminder of the upcoming deadline, your invoice drops on their priority list.

What to do: Use multiple touchpoints. Don’t rely solely on email, follow up with a quick SMS, a LinkedIn message, or even a polite call if the client is local. Make that invoice harder to ignore.

🧠 Fun Fact: SMS messages have a 98% open rate, compared to only 20% for email. That’s why a quick text can outperform a dozen emails when it comes to getting paid.

3. No Clear Consequences

Without late fees or service cutoffs, some clients see no harm in paying “eventually.” If nothing bad happens when they miss a due date, why hurry?

Other bills, like rent or payroll, take precedence because the stakes are higher.

What to do: Introduce small, clear consequences. Include late fees in your contract, pause ongoing work until invoices are cleared, or offer early-payment discounts to flip the script in your favor.

4. Financial Optimism… or Denial

Some clients genuinely believe they’ll have the money “next week.” Others are juggling multiple bills and hoping things magically align. Either way, they’re postponing payment, not maliciously, but optimistically (and sometimes irresponsibly).

What to do: Offer partial payments or milestone billing. Give them options that help them save face and make progress.

How to Get Customers to Pay Past Due Invoices (Without Burning the Bridges)

So, how do you turn psychological insight into practical action? Here’s your roadmap:

✅Step 1: Start with a Friendly Reminder

Most late payments are just human error. Maybe the client forgot. Maybe they thought someone else on their team paid for it. Your first move should always be a gentle nudge.

Example:

Keep it light. Keep it professional. No accusations, just clarity.

If you use Abillio, this step is even easier. The platform automatically sends payment reminders to your clients before and after invoices are due, so you don’t have to follow up manually. These built-in nudges help ensure your invoices stay top of mind, without you having to write awkward emails or chase people down.

🧠 Fun Fact: In 2017, Unicode introduced the receipt emoji (🧾), making it easier to send a quick payment reminder by text.

✅Step 2: Use Multiple Channels

Do not rely on email alone. People ignore emails. Or worse, they skim them and forget to act. Try mixing it up.

If the email gets no response, follow up with a text or a call. If the client is local or part of an ongoing relationship, a quick phone call can work wonders.

Hearing your voice makes it harder to avoid the issue. It also humanizes you and the situation. You are not just a line item in their inbox, you are a real person waiting to be paid.

✅Step 3: Offer a Solution, Not Just a Reminder

If the client is having trouble paying, offer a realistic solution. A payment plan, a partial payment today with the rest later, or even a short extension can be the difference between getting paid something and nothing.

This shows empathy and flexibility, without compromising your professionalism.

You could say: “I totally understand that cash flow can be tricky sometimes. If it helps, we can break this into two payments or set a new deadline that works better for you. Let me know what’s possible on your end.”

You are opening the door to cooperation instead of confrontation.

✅Step 4: Add Consequences That Make Clients Take You Seriously

If reminders and flexibility don’t move the needle, it’s time to add some accountability. This is where setting clear boundaries becomes essential.

You might need to take steps like:

- Charging a late fee for overdue payments

- Pausing ongoing work until the invoice is settled

- Escalating to collections or legal action, if absolutely necessary

These measures should be clearly outlined in your contract or terms of service. If they’re not already in place, now is a good time to update your agreements.

You can say something like: “I want to resolve this as smoothly as possible. If I don’t receive payment by [specific date], I’ll need to pause all ongoing work and may need to apply a late fee to the outstanding balance.”

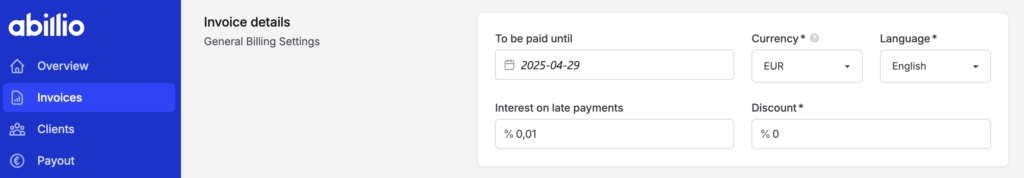

You can also use Abillio to automatically set interest on late payments after the due date, making it easier to manage overdue invoices and enforce your payment terms.

Preventing Unpaid Invoices in the First Place

The best way to handle unpaid invoices is to avoid them entirely. While you can’t eliminate the risk completely, you can lower it significantly with a few proactive steps.

Always Use a Contract

Even for small projects or repeat clients, having a written agreement protects both parties. Make sure it includes:

- Clear payment terms and due dates

- Late fees or interest for overdue payments

- Your right to pause services or take further action if payments are not received

This sets expectations and gives you something to refer back to when a client is dragging their feet.

🧠 Fun fact: The world’s earliest known bank dates back to ancient Babylon, around 2000 BC. Temples acted as financial hubs, storing grain and precious metals and even issuing loans.Your unpaid invoice would’ve meant talking to a priest to sort things out.

Invoice Immediately

The sooner you send your invoice, the fresher the work is in the client’s mind. Waiting too long can lead to confusion or apathy. Send the invoice the same day the work is completed or even before, if your contract allows for upfront or milestone billing.

Use an Invoicing Software That Works for You

Tools like Abillio make it easy to automate invoicing, send reminders, track payments, and manage compliance across different countries and currencies.

Less admin for you. Fewer excuses for them.

Set Shorter Payment Terms

Getting paid within 30 days is common, but asking for payment within 7 or 14 days can work better. Shorter timeframes create more urgency. Combine that with a small discount for early payments, and you might never have to chase an invoice again.

Conclusion

You started this to do great work, grow your business, and get paid fairly, not to become a part-time debt collector.

Late payments will happen, but they don’t have to derail your momentum. When you understand the psychology behind why clients delay and combine that insight with a solid follow-up system, you can protect your cash flow without losing your cool.

That’s where Abillio comes in. It keeps your invoicing on track by sending timely, automated reminders so you don’t have to. Your clients stay informed. You stay focused. And the awkward “just following up” emails? Gone.

Want to spend less time chasing payments and more time building what matters? Create your Abillio account for free and send your first invoice today.

FAQs

1. What is an unpaid invoice?

An unpaid invoice is simply a bill that has not been paid by the client within the agreed time frame. It becomes overdue once the due date passes without payment.

2. Can I charge interest on an unpaid invoice?

Yes, if it’s stated in your contract. Charging interest on overdue payments can motivate clients to settle their bills on time. Always make sure to include clear payment terms and late fees in your contract to avoid misunderstandings.

3. What should I do if a client claims they never received the invoice?

In this case, check that you sent the invoice to the correct address or email and consider using a reliable invoicing platform that tracks delivery. You may also want to follow up with a copy of the invoice and confirm it was received.