What are we gonna talk about:

What Is a Balance Sheet and Its Purpose?

Why Understanding the Purpose of a Balance Sheet Matters

Key Components of a Balance Sheet

Balance Sheet Example

How to Prepare Your Balance Sheet Step-by-Step

Common Balance Sheet Mistakes to Avoid

Final Thoughts

When you work for yourself, financial admin often falls to the bottom of your to-do list. But here’s the thing: if you want to grow your business, raise your rates, or simply sleep better at night, you need to know the purpose of a balance sheet and how to use it.

And no, we’re not just talking about how much you earned this month. We’re talking about your balance sheet, the financial snapshot that shows what your business owns, what it owes, and what’s left over for you.

Sounds complicated? It really isn’t.

In fact, understanding what a balance sheet is and its purpose might be the missing link between “freelancer with a spreadsheet” and “business owner with a plan.”

Let’s break it down: simply, clearly, and with real-life examples.

What Is a Balance Sheet and Its Purpose?

A balance sheet, also known as a Statement of Financial Position, is a financial report that shows what your business owns, what it owes, and what’s left over. It’s a snapshot of your business’s financial health at a specific point in time.

The purpose of a balance sheet is to help you see the true value of your business, track its financial position, and make better decisions about spending, saving, or investing.

Whether you’re a solopreneur, freelancer, or small business owner, knowing your balance sheet is essential. It’s the foundation for making smarter financial decisions, like when to invest in new tools, raise your rates, or outsource work.

Here’s the basic formula you’ll always see:

Assets = Liabilities + Equity

If the two sides don’t match, your books aren’t balanced, and that’s a sign something needs fixing.

Why Understanding the Purpose of a Balance Sheet Matters

Many freelancers assume they don’t need a balance sheet unless they run a big business. But that’s a mistake.

Here’s why the purpose of a balance sheet is so important:

- You don’t know what you actually earn until you compare assets and liabilities.

- It’s your financial gut check, helping you understand if you can afford to take a break, hire help, or invest in software.

- It’s required if you’re applying for a business loan, investor funding, or even some grants.

- Tracking it monthly helps you grow by showing trends over time, where money is leaking or stacking up.

According to Accounting Today, 67% of accountants say the balance sheet is the most underused financial report in small businesses.

In short: if you want to run your solo business like a pro, this is the document to master.

Key Components of a Balance Sheet

Every balance sheet has three main sections. Let’s unpack what goes where and why it matters:

1. Assets (What You Own)

Assets are everything your business owns or expects to benefit from.

Examples:

- Cash and bank balances – The money you already have in your business account or petty cash box.

Example: The €1,200 sitting in your bank right now. - Unpaid invoices – Money clients owe you for work you’ve already done but haven’t been paid for yet.

- Tools or tech – Physical items you bought for your business that help you work and still have value.

Example: Your laptop or camera - Prepaid subscriptions or software licenses

You’ll usually split them into:

- Current assets: usable or cash-convertible within 12 months

- Non-current assets: equipment, furniture, and other long-term holdings

2. Liabilities (What You Owe)

Liabilities are what your business owes to others.

Examples:

- Credit card balances – Money you’ve spent on your business credit card that you haven’t paid back yet.

Example: You bought a €200 microphone for a project and haven’t paid the card bill yet. - Unpaid taxes – Taxes you owe to the government but haven’t paid yet.

Example: VAT from last month’s invoices that’s due next week. - Loan repayments – Money you still need to pay back on a business loan.

Example: You borrowed €5,000 for new equipment and still owe €3,000. - Client deposits for future work – Money a client paid you in advance for work you haven’t done yet.

Example: A client sent you €500 to start a project next month.

Split these into:

- Current liabilities: due within a year

- Long-term liabilities: payable over a longer time (like a multi-year loan)

3. Equity (What’s Yours)

Equity is what’s left after you subtract liabilities from assets.

It includes:

- Your original investment in the business

- Retained earnings (profits kept in the business)

- Net income (current year’s profit)

Equity = Assets – Liabilities

Balance Sheet Example

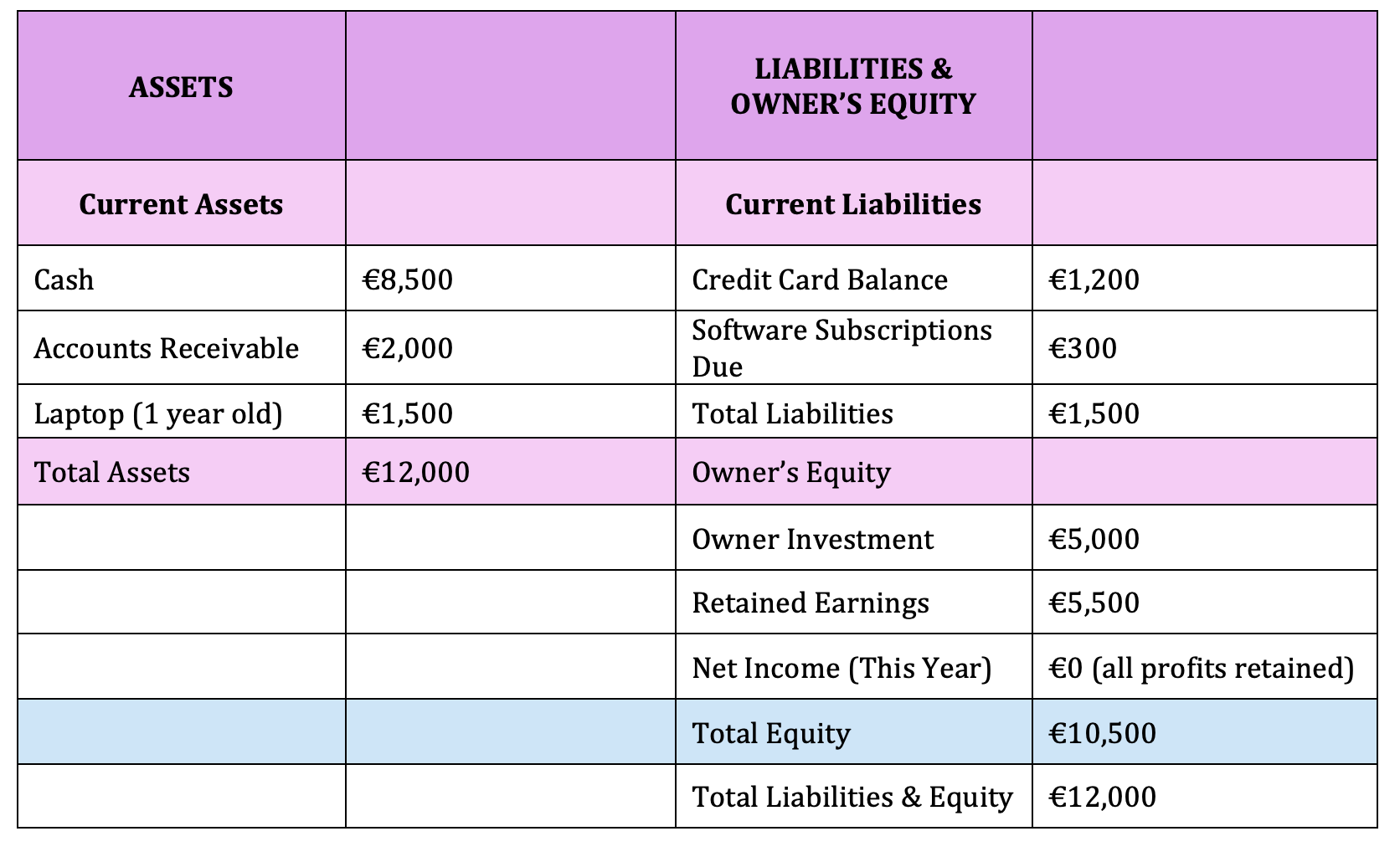

Let’s meet Niko, a freelance video editor. He’s been working with international clients and wants to understand where he stands financially.

Here’s a simple breakdown:

This shows that Nick is in a solid position. He owns more than he owes and his value is growing.

How to Prepare Your Balance Sheet Step-by-Step

Step 1: Collect your data

Pull your latest bank statements, invoices, expense reports, and loan info.

Step 2: List all your assets

Include cash, unpaid invoices, and valuable business equipment.

Step 3: List all your liabilities

Include upcoming bills, outstanding credit, and unpaid taxes.

Step 4: Calculate your equity

Use the formula: Assets – Liabilities = Equity

Step 5: Check that it balances

Double-check that total assets = total liabilities + equity. If not, look for data entry errors.

Common Balance Sheet Mistakes to Avoid

Mistakes happen, especially when you’re new to bookkeeping. Here are a few to avoid:

❌ Classifying purchases as expenses instead of assets (e.g. treating a €1,000 laptop as a one-time cost)

Example: You buy a €1,000 laptop for your work. If you call it just an “expense,” it disappears from your balance sheet. But it should be listed as an asset because it still has value.

❌ Leaving out small debts your business owes.: like unpaid invoices, subscriptions, or taxes

Example: You have a €50 unpaid software subscription or €200 in taxes due next month. Even small amounts add up and should be recorded.

❌ Not accounting for the fact that equipment and other assets lose value over time

Example: Your €1,000 laptop might only be worth €500 after two years, but if you don’t adjust it, your balance sheet will be misleading.

❌ Not updating regularly: your balance sheet should be refreshed monthly

Example: If you update it only once a year, you might miss that your cash is running low in March. Monthly updates keep the picture accurate.

Final Thoughts

So, what is the purpose of a balance sheet for freelancers and solopreneurs?

It’s your go-to tool for understanding where your business stands, making smart financial decisions, and proving your stability to lenders or investors.

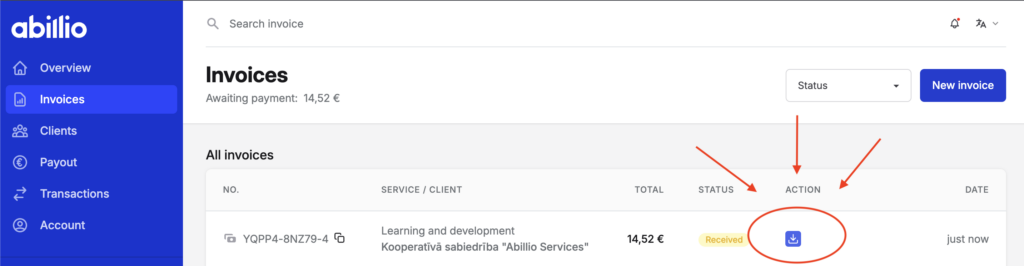

That’s where Abillio comes in.

While we don’t generate your balance sheet, we give you a solid starting point. With VAT-compliant invoicing, international payment options, and essential compliance features, all in one place. No company registration needed.

So, what if you do need a balance sheet, say for a loan application or to share with your accountant?

Here’s how to get there:

- Export your invoices from Abillio (CSV or PDF)

- Import it into accounting software like QuickBooks, Xero, or your preferred local tool and generate your full reports.

Abillio handles the invoicing and payment side, so pulling together your financial picture is faster and easier.

FAQs

1. What’s the difference between a balance sheet, an income statement, and a cash flow statement?

The balance sheet shows what a business owns and owes at a single point in time, the income statement shows how much it earned and spent over a period, and the cash flow statement shows how cash moves in and out of the business.

2. How often should I update and review my balance sheet?

You should review your balance sheet every month. It helps you keep track of what you own, what you owe, and makes sure your numbers stay accurate.

3. Do I need balance sheet?

You might need to keep books and prepare a balance sheet for tax, legal, or regulatory reasons. But even if it’s not required, it’s still a good idea – creating a balance sheet can help you keep track of what your business owns, what it owes, and what it’s really worth.