Global freelancing made hassle-free

Rated Excellent on Trustpilot

Trusted solution for freelancers and business globally

13k

Trusted freelancers

20k

Processed invoices

15m

Distributed in payouts

158

Countries

Discover Abillio's Core Features

All in-one platform for invoicing, accounting, and payments without needing to set up your own company – use our company-as-a-service instead.

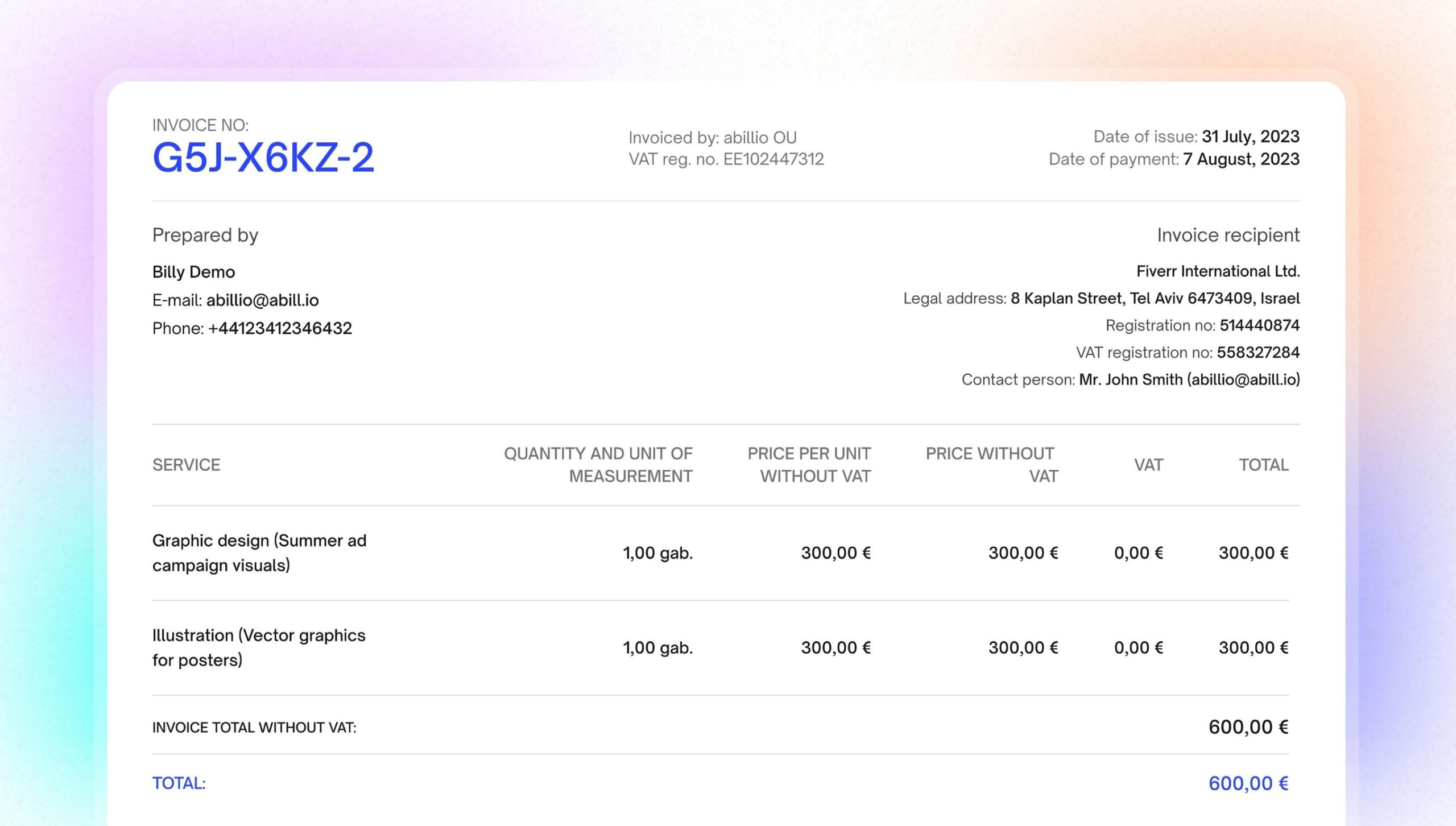

Send business-friendly invoices with VAT to your clients globally to 158 countries and 8 currencies.

Pay-as-you-go with no monthly commitment. Preview the amount available for withdrawal before sending the invoice. See how much tax will be withheld and transferred to the tax authority. Abillio keeps 5% service fee from each payout.

Legal documentation and streamlined service agreement for every client available. Additionally, custom agreements and copyright transfer contracts upon request.

No more late payment chasing – we will do it for you.

Receive payouts to your personal bank account, card, paypal or crypto wallet!

We do tax accounting and payments on your behalf, so you can focus on your work. Depending on your tax residency, we pay your income tax too. Currently, we support income tax payments for Latvia and Estonia. More countries coming soon.

Start invoicing clients in 158 countries in 5 minutes. Globally recognized invoice with your name on it

Payout calculator

No subscription plans.

To find out if your invoice will be subject to VAT, visit this page.

Additionally, payments are subject to a bank fee, which depends on the payment method:

- The SEPA payment fee is up to 1 EUR.

- The SWIFT payment fee is up to 20 EUR.

- The crypto payment fee is 1,5 %.

- The PayPal payment fee is 0%.

Income tax applies to certain countries.

Frequent invoicer? Apply for special rates.

Client will pay

1000 EUR*You will receive

1000 EURHow it works

Set up your account

Sign up, add your bank details, as well as the details of your client

Create an invoice and send it

Create a business-friendly invoice and have Abillio to send it in your behalf together with service agreement.

Receive payment

Abillio collects payment and transfers payout to your account

What our users say

Explore real stories from freelancers and see why they trust us to handle their tax and payments, improve workflow, and boost productivity.

Frequently Asked Questions

Everything you need to know about the invoice and billing. Can’t find the answer you’re looking for? Please chat with our friendly team.

Abillio is an all-in-one platform for invoicing, accounting, and payments that allows you to invoice your clients globally without needing to establish a legal entity, open a business bank account or apply for VAT. Abillio’s company-as-a-service solution takes care of it for you.

Abillio services are intended for freelancers, solopreneurs and independent contractors who want to run their business quickly and without administrative hurdles – by providing them with legal entity and VAT number to invoice their cross-border customers.

Depending on your client’s location, value added tax or VAT might be added to your invoice. Mostly it’s 0%, unless you’re located in Latvia or Estonia. More info here. Abillio service fee is 5% from payout, plus bank fee.

Unfortunately, for your personal taxes, we do not provide any services (except for Latvia tax residents). You are responsible for declaring your income and paying your taxes if your income exceeds the untaxable threshold. However, we do provide a document showcasing all the transactions and earnings.

Yes, you can send invoices to your cross-border customers because Abillio provides you with a VAT number. You can create invoices and receive payments in Euros, (EUR), US Dollars (USD), British Pounds (GBP), Canadian Dollars (CAD), Australian Dollars (AUD), Hungarian Forint (HUF), Bulgarian Lev (BGN), Tether (USDT). However, suppose your client pays in a currency other than the supported one, in that case, the received amount will be converted by bank, and may differ depending on the currency exchange rate on the receipt day, as international transfers may take 3-7 business days. In this case, your invoice amount will be adjusted post-factum to match the amount converted to your currency. When adding a customer, it is important to remember to enter their tax identity number (TIN) and VAT ID number. VAT rate will be 0%, except for businesses located in Estonia (22%) or Latvia (21%).

We provide a streamlined service agreement that must be digitally approved by the customer upon receipt of the invoice and protects both your and our interests. If you believe it requires clarification or modifcation, please contact us at [email protected]. If you need to sign a custom agreement or any other document, please include Abillio OU company information and send it to [email protected]. We will digitally sign it and send it back to you and client.

Money will be available for withdrawal to your private bank account / PayPal / Crypto wallet once the customer has fully or partially paid the invoice. You can initiate the withdrawal in the Payout tab, or it will process automatically if you have selected ‘Automatic payout.’ Payouts occur every business day. Transfers up to 15,000 euros within SEPA (Single European Payments Area) are completed the same business day.

Abillio uses Wise, enabling 57% of cross-border payments to settle instantly and 90% within an hour. For SWIFT payments, timing depends on clearing, usually taking a few hours to 7 business days.

Yes. To learn more about Abillio’s offer for businesses, head here. To learn more about Abillio’s offer for marketplaces, head here.

Still not sure? Join our newsletter community

Subscribe to our monthly newsletter to receive Abillio updates and top content for freelancers!

SIA “Abillio” concluded with LIAA on 05.04.2022 contract no. SKV-L-2022/162 on receiving support within the framework of the “Promotion of International Competitiveness” measure, which is co-financed by the European Regional Development Fund.

SIA “Abillio” (reg. no. 40203284112) implements project No. JU-PI-2022/50 in accordance with the European Regional Development Fund project “Technology Transfer Program” (project identification number 1.2.1.2/16/I/001) start-up activities support law program for attracting highly qualified workers, adapting and localizing digital platforms for the international market